value appeal property tax services

Valuation Appeal or Property Tax Appeal The property is residential. The Middlesex County Board of Taxation is located at 75 Bayard Street 4th Floor New Brunswick NJ 08901.

Four Important Key Points To Lower Hotel Property Taxes Property Tax Property Property Values

The assessor must enroll the lessor of the two.

. A successful base value appeal is a permanent reduction in assessed value. The appeals reduced the assessed value only on the properties whose owners successfully appealed. Commercial industrial personal with a State Equalized Value in Contention LESS than 100000.

Ad Find Recommended New Jersey Tax Accountants Fast Free on Bark. TAX APPEAL CONSULTANTS provides no stress property tax appeal services for all types of real property throughout Southern California. If not we are happy to answer your email or phone questions.

For Information regarding the tax appeal process please click on the link below. Here you have two options. If you can prove that your assessed value is substantially more than you could sell your property for you may want to consider an appeal.

The 2022 Board of Equalization and Review will adjourn from the taking of appeals on May 11 2022. With only a portion of properties being adjusted to market value an unfair shift in the tax burden was created. Washington State law requires the assessed value of a property reflect 100 of market value.

You can do the initial research. In addition to our appeals service we provide personal property form filing and property tax management services. 7 Reasons To Submit a Property Tax Appeal Letter.

Filing is normally required by May 1st. 6 steps to appealing your property tax bill. You may obtain petition forms by calling 503 846-3854 or go to our Board of Property Tax Appeals BoPTA website.

We monitor your property values applying our knowledge of. Those assessments are mailed out the beginning of June each year. 1 You can pay the too-high tax bill because you think you dont have time to stage an appeal.

In contrast an appraisal is an unbiased opinion of value for which contingent fees are prohibited. For questions or assistance please contact our office at Tax_assessordconcgov or 919-560-0300. A missed deadline or incorrect filing can cause an appeal to be dismissed.

We are acting as Tax Agents in this service. Its possible to trim your property tax bill by appealing the value the tax assessor assigned to your home. Taxable value of real property is determined by the Factored Base Year Value or current market value as of January 1 of that tax year.

Hopefully you will find the information you are seeking about Reasons To Appeal Property Taxes. Commercial industrial personal with a State. The property is non-residential ie.

Challenging the property assessments can be a time. Here at Tax Appeal Consultants we are passionate about Real Estate Property Tax Issues Property Tax Appeals and especially Property Tax Reductions. The Appeals Process Step-By-Step.

The property is non-residential ie. Assessed values can only be appealed when the assessment notices are mailed out. Posted by Peter Jordan in new jersey property tax appeal property tax appeal on March 17 2012 Thursday March 15 2012 More city homeowners are appealing their property tax bills than in years past as the levy which has doubled in the 10 years since Mayor Michael Bloomberg took office continues to increase according to officials.

If you have value questions you may call 503 846-8826. Real estate value appeals may be filed after January 1 and until the adjournment of the Board of Equalization and Review usually in May each year or within 30 days of any value change notification. Daniel Jones handles all residential property tax appeals.

Middlesex County Board of Taxation is located at 390 George Street Suite 220. You may obtain a real estate appeal form here or contact our office to. The Board of Property Tax Appeals BoPTA is comprised of independent citizens appointed by the Board of Commissioners.

With the decline the housing market Montclair property owners have filed 3724 tax appeals since 2007. This is especially likely in high-tax high-cost states like New Jersey where a 600000 home with an effective 4 property tax rate carries a 24000 annual tax burden. There is an appeal process to assist property owners in presenting their concerns about property valuation.

At NTPTS we believe that your property taxes should be equitable and based on the true value of your property. We save property owners time and money appealing property taxes. When we compare it to the assessed value and theres a value gap we navigate the property tax appeal system to close the gap achieve a reduction of value and lower property taxes.

That assessed value is whats used to calculate how much tax you owe. Please note tax appeals for properties located in Piscataway Township must be filed with Middlesex County Board of Taxation on or before April 1 each tax year. They are authorized by law to hear appeals of your propertys value not the.

Our Full-Service Property Tax Appeal Process If you disagree with your property assessment 7047 grants you the right to appeal. Please do not use 2021 forms for 2022 appeals. Fair Assessments may lower your residential property taxes by reducing and capping tax assessments.

Please note that tax appeals for properties located in Piscataway Township must be filed with Middlesex County Board of Taxation. How are annual property tax assessments calculated in California. 8179000 Original Assessed Value.

We analyze value based in fact supported by market data and income potential. Ad Reduce property taxes for yourself or others as a legitimate home business. Your interest in Reasons To Appeal Property Taxes indicates you.

From The Montclair Patch. Hoppe Associates specializes in results-oriented property tax appeals. Residential Tax Appeal Services.

All 2022 real property appeals must be filed by 500 pm. If the assessed value exceeds market you are paying more than your fair share of taxes. It all starts when you open a valuation notice from the assessor and see a property valuation amount that you believe is too high.

We provide residential tax appeal services specializing in high-end residential properties in Dallas Collin Denton and Tarrant counties. In this case a 10 reduction in your assessed value which is a. Appeal involving medical office building with 3 parcels functioning as one economic unit.

Read the instructions carefully and call the phone numbers on the form if. We dont want you to pay more property taxes than you should be paying so if you think your. All appeals must be requested by the fourth Monday of June.

One way to lower your property tax is to show that your home is worth less than its assessed value. Property taxes are an expected cost but they need to be managed by professionals. At Fair Assessments we have the knowledge experience and resources to successfully appeal a wide variety of residential properties.

Daniel has 31 years of real estate valuation experience as a fee. 3973300 Revised Assessed Value. There are many factors that determine how your value affects your taxes and you will need to understand those factors in order to file a successful appeal.

Choose the options below that identifies your need and let Hoppe Associates assist you with your questions and property. Reduce property taxes 4 residential retail businesses - profitable side business hustle.

Property Tax Appeals Process Property Tax Tax Property

Hotel Property Tax Consultant Property Tax Tax Reduction Tax

Secured Property Taxes Treasurer Tax Collector

Lake County Assessors Clash Over Property Value Hikes Lake County Property Values Property

Property Tax Appeals When How Why To Submit Plus A Sample Letter

![]()

Property Tax Advisory Services Deloitte Us

Property Tax Appeal Appeal Property Tax Property Tax Appeal Houston Property Tax Appeal Texas Property Tax Appealing Tax

Hotel Property Tax Consultant Springville Property Tax Commercial Property

Commercial Property Tax Solutions Corelogic

Best Payslips Service In Uk In 2022 Number One Service 20 Years

Need Help Fighting Your Property Taxes Have You Signed Up For Our Free Seminar In The Woodlands Yet Ken Property Tax Selling Real Estate Real Estate Buying

Real Estate Checklist Listing Real Estate Forms Realtor Etsy Real Estate Forms Real Estate Checklist Real Estate Tips

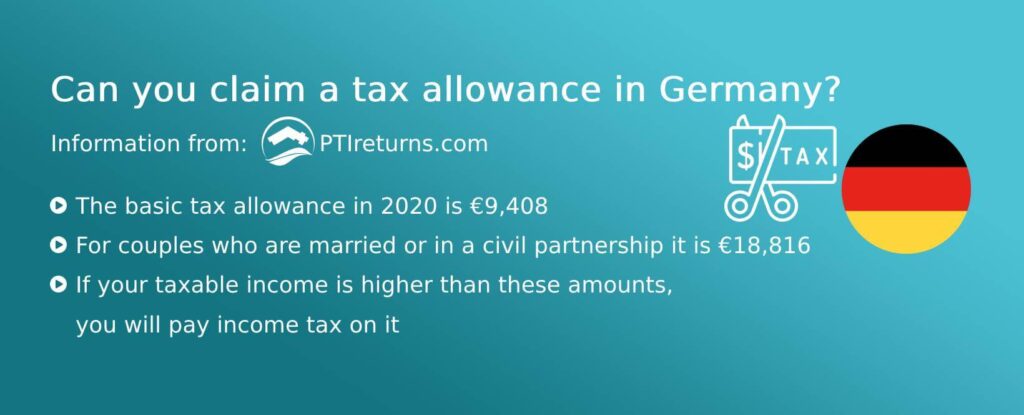

German Rental Income Tax How Much Property Tax Do I Have To Pay

German Rental Income Tax How Much Property Tax Do I Have To Pay

Residential Five Stone Tax Advisers

What Are The Requirements When Getting An Ein Tax Season Tax Time Capital Gains Tax

Residential Property Tax Protest Services Swbc

Which Services Provide A Payslips Company In 2022 National Insurance Number Service To Focus